Section 179 depreciation calculator

With a 1050000 deduction limit youll be able to deduct the full cost of equipment and get. A full 30k jump from last year.

Macrs Depreciation Calculator With Formula Nerd Counter

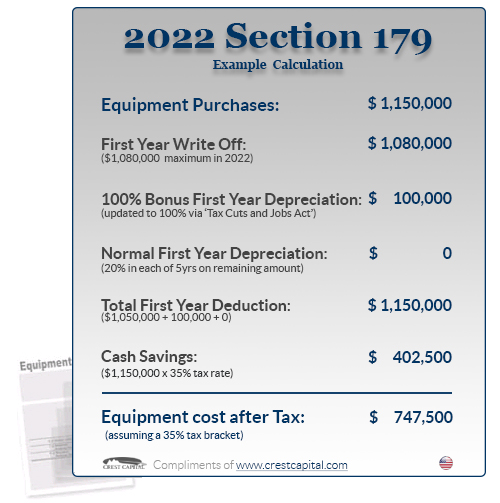

The 2022 Section 179 deduction is 1080000 thats one million eighty thousand dollars.

. The Section 179 Deduction is now 1000000 for 2019. Section 179 does come with limits - there are caps to the total amount written off 1050000 for 2021 and limits to the total amount of the equipment purchased. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

Section 179 Deduction Calculator Under the Section 179 tax deduction you are able to deduct a maximum of 1080000 in fixed assets and equipment as a form of business expense. Section 179 deduction limit is now 1080000. Ad Trade some of your pharmacys tax bill for new tech - Section 179 offers a way to save.

The Section 179 deduction limit for 2017 is 500000. What are my tax savings with Section 179 deduction. Make your pharmacy more productive profitable when you use this tax benefit with Parata.

When you have entered the above amounts in the taxpayers details section Section 179 Deduction will calculate the total amount of deduction. The bonus depreciation calculator is proprietary software based on three primary components. Section 179 Calculator for 2022 Get an estimated tax write-off amount for qualifying Section 179 property that you purchase in 2022.

This limit is set by the IRS and is listed in our 179 tax calculator. Total Amount Of Deduction Section. Section 179 calculator for 2022 Enter an equipment cost.

Section 179 Tax Deduction calculator an easy to use calculator to estimate your tax savings on equipment purchase through section 179 deduction in 2019 and tax year 2018. 2022 Section 179 Deduction threshold for total amount of equipment. Section 179 deduction dollar limits.

100 bonus depreciation for 2022 new and used equipment allowed. Section 179 of the IRS tax code gives businesses the opportunity to deduct. Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is.

Use the Section 179 Deduction Calculator to help evaluate your potential tax savings. Bloomberg Tax Offers Full-Text of the Current Internal Revenue Code Free of Charge. This limit is reduced by the amount by which the cost of.

If the value of the equipment is less. Limits of Section 179. Includes Editors Notes Written by Expert Staff.

This is a very healthy tax deduction and means businesses can deduct the full cost of qualifying equipment from their 2017 taxes up to. Section 179 Calculator for 2022 Get an estimated tax write-off amount for qualifying Section 179 property that you purchase in 2022. The Section 179 Deduction and Bonus Depreciation apply for both new and used equipment.

Jan 4 2022 The Section 179 deduction for 2022 is 1080000 up from 1050000 in 2021. Ad Trade some of your pharmacys tax bill for new tech - Section 179 offers a way to save. Tax deduction If a company purchases more than 2000000 in a single tax year and elects the 179 tax deduction the 179.

Use Our Section 179 Deduction Calculator To Find Out. Make your pharmacy more productive profitable when you use this tax benefit with Parata. This means businesses can deduct the full cost of.

This means your company can buy lease finance new or used. Companies can deduct the full price of qualified equipment purchases up to. Section 179 allows you to take the cost of certain types of business property and subtract up to 1050000 of it from your taxable income for the year you purchase it.

Section 179 can save your business money because it allows you to take up to a 1080000. Prior Year Calculators Section 179 Tax Deduction Limits for year 2019. 1 in-depth understanding of the types and amounts of qualifying short-life assets 2.

Ad Site is Updated Continuously.

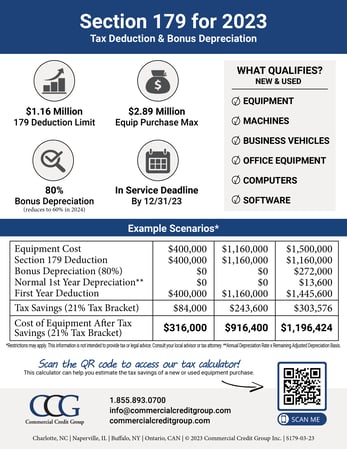

Section 179 Calculator Ccg

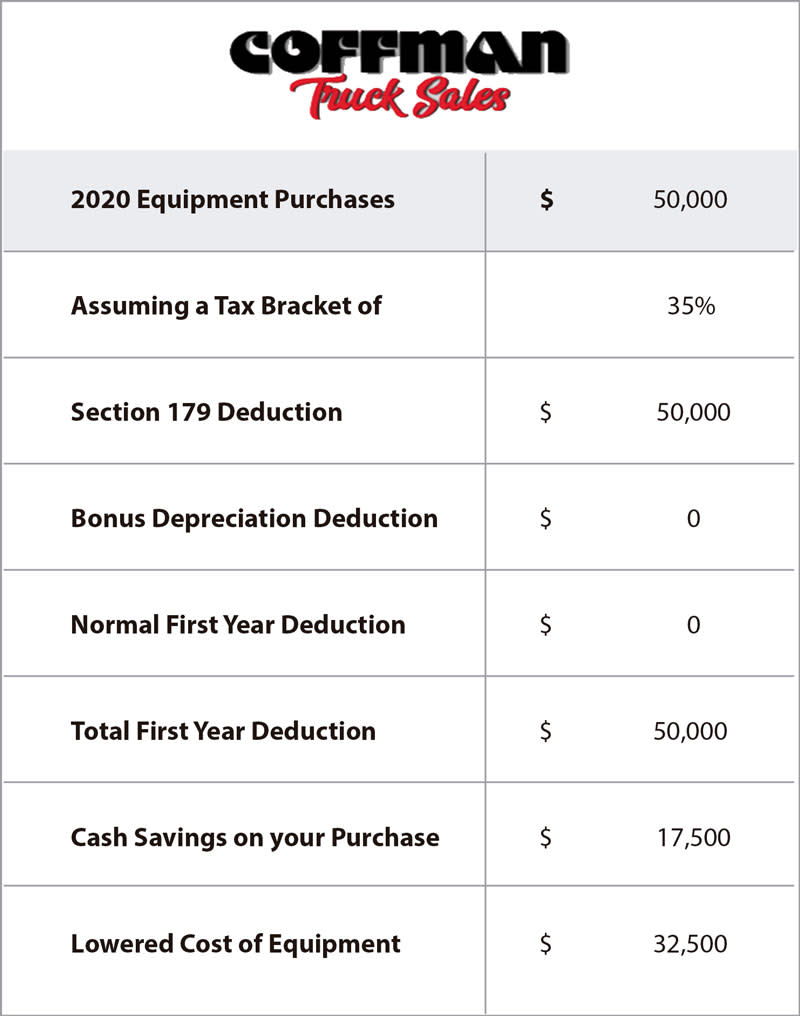

Section 179 Tax Deduction Coffman Truck Sales

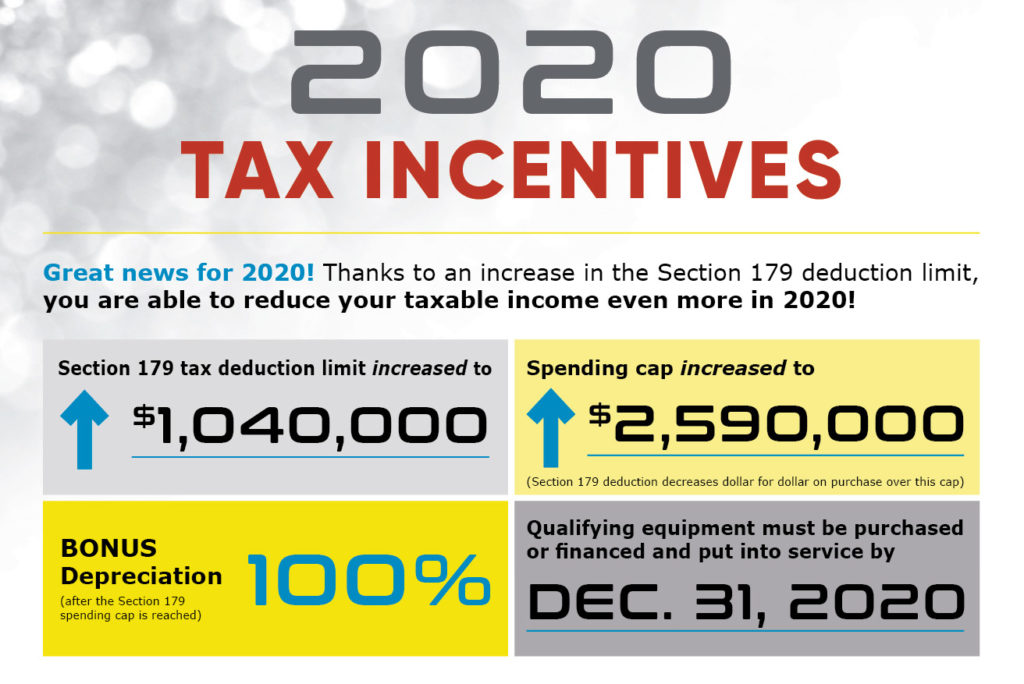

Section 179 Tax Deduction Gt Mid Atlantic

Depreciation Of Business Assets Definition Calculation How It Affects Your Taxes

Section 179 Tax Deduction Home Facebook

Calculate Your Potential Section 179 Tax Deductions On New Equipment Bpi Color

Section 179 Tax Deduction Home Facebook

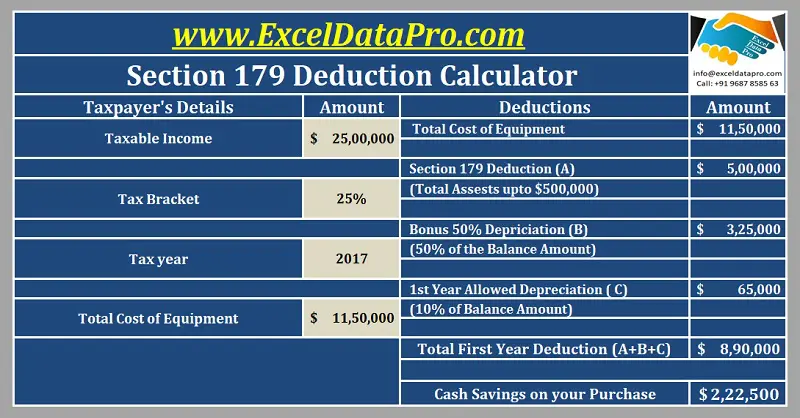

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek

Section 179 Archives Stimulus Acts Section179 Org

Download Section 179 Deduction Calculator Excel Template Exceldatapro

Section 179 Deduction Hondru Ford Of Manheim

Free Section 179 Deduction Calculator For Us Internal Revenue Code

Section 179 Tax Deduction Preston Cdjr Millsboro De

2021 Section 179 Deduction Calculator Guide For Equipment Equipment Radar

Tax Depreciation The Impact Of Depreciation On Taxes Agiled App

Calculate Your Potential Section 179 Tax Deductions On New Equipment Bpi Color

Take Advantage Of The Section 179 Deduction Arcoa Group